June 2019 NEWSLETTER Page 1

News of Interest to Credit Unions Regulated by the Credit Union Department

Newsletter

No. 06-19 June 19, 2019

Notice of Regular Commission Meeting

The Credit Union Commission will hold its Regular meeting on

Friday, July 12, 2019, at 9:00 a.m., in the Department’s conference

room. The agenda and meeting packet will be available on our

website on or about July 1, 2019.

~~~~~~

NASCUS State System Summit

Join Commissioner Kolhoff at the NASCUS Summit which is quickly

approaching (August 13-16) in San Francisco. The Summit is the only

national meeting focusing exclusively on the state credit union

system. This national meeting brings together state credit union

regulators and industry policy makers from around the nation for

mutual exchange and dialog.

Click here for hotel, registration,

agenda information.

This year’s planned talking points include the state of the state credit

union charter and how it should evolve, implications of providing

financial services to the hemp industry, compliance updates,

NACUSO’s Next Big Idea Winner and FINTECH implications,

communicating in crisis scenarios, the credit union officials and

regulators role in responding to harassment claims and the #MeToo

movement, interstate branching, developing an ERM focused

culture, cybersecurity and legislative issues impacting the state

charter. NCUA Chair Rodney Hood is also scheduled to speak on his

views of the credit union system and its future.

~~~~~~

Upcoming Holiday Schedule for CUD

The Department’s office will be closed on July 4

th

in observance of

Independence Day.

Credit Union Department

914 East Anderson Lane

Austin, Texas 78752

Phone: 512-837-9236

Fax: 512-832-0278

Email: info@cud.texas.gov

Web Site: www.cud.texas.gov

The Credit Union Department (CUD)

is the state agency that regulates

and supervises credit unions

chartered by the State of Texas. The

Department is professionally

accredited by the National

Association of State Credit Union

Supervisors (NASCUS) certifying that

CUD maintains the highest

standards and practices in state

credit union supervision.

Our Mission is to safeguard the

public interest, protect the interests

of credit union members and

promote public confidence in credit

unions.

* * * *

Credit Union Commission

The Commission is the policy making

body for CUD. The Commission is a

board of private citizens appointed

by and responsible to the Governor

of Texas.

Members:

Allyson “Missy” Morrow, Chair

Sherri Brannon Merket, Vice Chair

Elizabeth L. “Liz” Bayless

Beckie Stockstill Cobb

Yusuf E. Farran

Steven “Steve” Gilman

Jim Minge

Kay Stewart

Rick Ybarra

Next

Commission Meeting

Friday, July 12, 2019 beginning at 9:00

a.m. in the offices of CUD.

* * * *

June 2019 NEWSLETTER Page 2

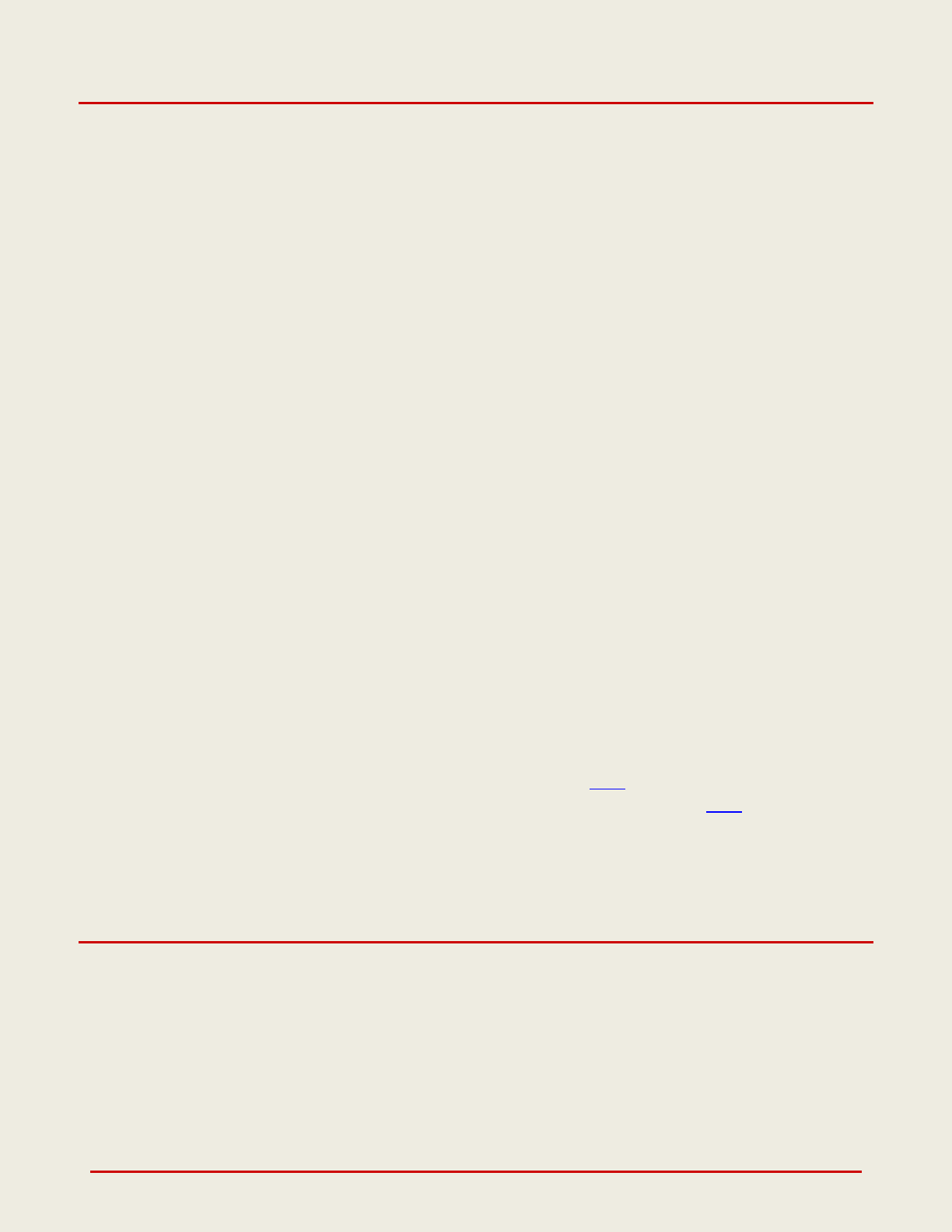

Hurricane Season

Climatologists have predicted a near normal 2019 Atlantic hurricane season that could include nine to 15

named storms, including four to eight hurricanes. Two to four of those hurricanes are expected to grow

to major hurricanes with storm winds exceeding 110 mph, Category 3 or stronger. Credit unions are

reminded that it only takes one hurricane making landfall to make it an active season for them and

encouraged to prepare diligently for every season. Emergency preparedness guidelines can be found

here and at the NCUA. It is imperative officials remain cognizant of the requirements of TAC 91.5001,

including emergency office closure notification requirements under (c) and keeping credit union officials

NCUA CU Online Profile contact information accurate to comply with (d).

~~~~~~

Elder Abuse/Financial Exploitation

Credit unions know they need to report elder abuse on a suspicious activity report under the Bank

Secrecy Act (BSA). However, many financial institutions in Texas remain unaware that they also have an

obligation to report suspected elder abuse (physical or financial) to the state of Texas as well. This state

reporting requirement has been in place for years, however a 2017 law brought it to a new light.

Chapter 280 to the Finance Code requires financial institutions to report financial exploitation of

vulnerable adults (over 65 years old or disabled) to the Department of Family and Protective Services

(DFPS). Although the provision in the Finance Code specific to financial institutions is new, the

requirement to report is not. Current Human Resources Code Section 48.051 already required all

persons (including credit unions) to report abuse.

The 2017 law requires credit union employees who believe a member may be subject to financial

exploitation to notify the credit union. The credit union is required to report suspected financial

exploitation to DFPS. The report must be submitted not later than the earlier of: 1) the date the

assessment is complete, or 2) the fifth business day after the date the credit union is notified of the

suspected financial exploitation. In other words, a report should be filed with the DFPS within 5 days or

sooner, far earlier than the 30-day deadline for filing a suspicious activity report under BSA.

June 2019 NEWSLETTER Page 3

Elder Abuse/Financial Exploitation (Continued)

A credit union that makes such a report under Finance Code Chapter 280 is not required to make an

additional report of suspected abuse, neglect, or exploitation under the Human Resources Code Section

48.051 (the current law regarding reporting abuse).

Credit unions must adopt policies and procedures that require employees to identify exploitation and

promptly notify the appropriate point person at the credit union. The policies and procedures should

also address training staff, investigating abuse, reporting abuse, and placing holds on accounts. The

credit union must investigate and timely file any necessary reports. The policies and procedures may

authorize the credit union to report the suspected financial abuse to other appropriate entities such as

the Office of the Attorney General, the Federal Trade Commission, and the appropriate law enforcement

agency. As a reminder, financial exploitation also triggers a requirement to file a suspicious activity

report.

At the time of submitting a report to DFPS, the credit union is authorized to also notify a third party

reasonably associated with the vulnerable adult (such as a family member) if that person is not a

suspect.

If a credit union submits a report, it may place a hold on any transaction involving an account of the

vulnerable adult suspected to be tied to financial exploitation. A mandatory hold on transactions may

also be requested by DFPS or a law enforcement agency.

A credit union employee who makes a notification and a credit union that files a report or otherwise

participates in judicial proceedings is immune from any civil or criminal liability unless acting in bad faith

or with malicious purpose. A credit union is immune from civil or criminal liability or disciplinary action

resulting from placing or not placing a hold on transactions.

Credit unions shall provide related documentation, on request, to DFPS, law enforcement, or a

prosecuting attorney's office.

DFPS has provided resources for submitting reports on its website here. Reports can be made by phone

at 1-800-252-5400 (for urgent or emergency situations) or through DFPS's website here.

~~~~~~

Board Meeting Attendance and Training

Critical to the long-term success of a credit union is an active, involved board that provides proper

oversight of operations and a sound strategic direction for the future of the credit union. One of the

keys to ensuring that a board is successful is regular, participatory attendance.

The issue of board attendance is a tricky one. Board members are volunteers with their own jobs,

families, and busy lives to balance in addition to the voluntary obligations of serving on a credit union

board. However, missed meetings seriously diminish the effectiveness of the entire board, and a

director’s irregular or inconsistent meeting attendance could result in removal from the board.

June 2019 NEWSLETTER Page 4

Board Meeting Attendance and Training (Continued)

Texas Finance Code Section 122.055 provides that the office of a director becomes vacant if the director

has been absent from more meetings than the total number of absences permitted by commission rule.

Under 7 TAC Section 91.501 (g), any director who fails to attend three consecutive regularly scheduled

meetings without an excuse approved by a majority vote of the board or fails to attend six regularly

scheduled meetings during any twelve-month period (whether the absences are excused or not) is

automatically removed from office.

Another key to be a successful board member and contributing to the success of the credit union is

annual continuing education, which is required by 7 TAC Section 91.501 (d). Directors must develop and

maintain a fundamental, ongoing knowledge of the regulations and issues affecting credit union

operations to assure a safe and sound institution. A written board policy which establishes appropriate

continuing education requirements and provides enough resources for directors to achieve and maintain

professional competence is required. The long-term viability of your credit union depends upon having

active, engaged, knowledgeable board members.

~~~~~~

Publication Deadlines

In order to meet the submission deadlines for the applicable issues of the Texas Register, it is necessary

for the Department to establish the schedule shown below. Completed applications received after the

deadline for the month cannot be published until the following month.

Publication Date Application Deadline

July 2019 Friday, July 12

August 2019 Friday, August 16

~~~~~~

Applications Approved

Applications approved since May 15, 2019 include:

Credit Union Changes or Groups Added

Field of Membership – Approved:

Texas Bay CU (Houston) See Newsletter No. 03-19

EECU (Fort Worth) See Newsletter No. 03-19

City CU #1 (Dallas) See Newsletter No. 04-19

City CU #2 (Dallas) See Newsletter No. 04-19

City CU #3 (Dallas) See Newsletter No. 04-19

City CU #4 (Dallas) See Newsletter No. 04-19

~~~~~~

June 2019 NEWSLETTER Page 5

Applications Received

The following application was received and will be published in the June 28, 2019 issue of the Texas

Register.

Field of Membership Expansion:

Texell Credit Union (Temple) – Persons who live, work, worship or attend school in McLennan County,

Texas.

Mobility Credit Union (Irving) – Persons who live, worship, attend school or work in Parker County,

Texas.

Mobility Credit Union (Irving) – Persons who live, worship, attend school or work in Johnson County,

Texas.

~~~~~~

This newsletter is produced monthly as a part of the Department’s continued communication outreach

with the credit unions it regulates. Delivery is generally provided by electronic notification of its

availability on the Department’s website.

Suggestions and comments concerning the newsletter or its content are welcomed.

~~~~~

To learn more about CUD click http://www.cud.texas.gov or contact us at 914 E. Anderson Lane, Austin, TX 78752